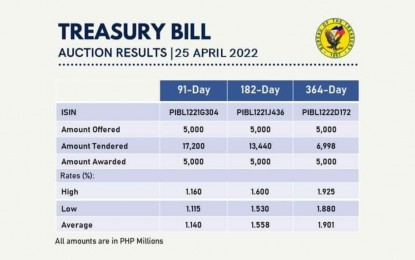

VOLATILITY. The rate of Treasury bills (T-bills) moves in different directions on Monday (April 25, 2022), which has been traced partly to volatility given the inflation developments in the United States. An economist said the decline in oil prices in the international market is among the factors in the T-bill auction. (Photo screengrab from Bureau of the Treasury's Facebook page)

MANILA – The rate of Treasury bills (T-bills) ended mixed on Monday but all tenors remained oversubscribed.

The average rate of the 91-day T-bill declined to 1.140 percent and the 182-day to 1.558 percent but that of the 364-day rose to 1.901 percent.

These were at 1.223 percent, 1.568 percent and 1.877 percent for the 91-day, 182-day, and 364-day T-bills during the auction last April 18.

The Bureau of the Treasury (BTr) offered all tenors for PHP5 billion each, and the auction committee made a full award across the board.

Total bids for the three-month paper amounted to PHP17.2 billion while these reached PHP13.44 billion for the six-month paper and PHP6.998 billion for the one-year securities.

National Treasurer Rosalia de Leon earlier traced the volatility in the T-bill rates to expectations for additional hikes in the Federal Reserve’s key rates.

This is partly due to the continued acceleration of the consumer price index in the US, which is at its 40-year high in the first quarter of 2022.

The Fed’s key rate was hiked by 25 basis points last March, the first since December 2018, to between 0.25 to 0.50 percent.

Rizal Commercial Banking Corporation (RCBC) chief economist Michael Ricafort, in a reply to e-mailed questions from the Philippine News Agency, said T-bill rates were “mostly lower week-on-week after global oil prices eased to near two-week lows.”

He said the price of oil at the NYMEX commodities exchange declined to around USD97 per barrel.

“(This price decline) could help ease inflationary pressures, as well as a seasonal increase in tax revenue collections in April and the recent foreign bond sales by the government, both of which would reduce the need for the government to borrow from the domestic market, as the elections are exactly two weeks from now” he added. (PNA)