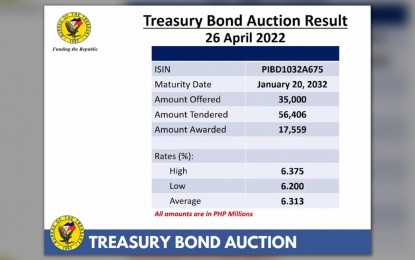

MORE HIKES. The 10-year Treasury bond (T-bond) rate rises on Tuesday (April 26, 2022), resulting in the partial award of the debt paper. Rizal Commercial Banking Corporation (RCBC) chief economist Michael Ricafort traced the rate increase to investors' anticipation for more hikes in the Federal Reserve's key rates. (Photo grabbed from BTr Facebook page)

MANILA – The 10-year Treasury bond (T-bond) rate rose on Tuesday, resulting in the partial award of the debt paper during an auction by the Bureau of the Treasury (BTr).

The average rate of the securities rose to 6.313 percent from 6.092 percent in the previous auction.

The auction committee awarded PHP17.559 billion worth of debt paper from an offering of PHP35 billion. Total tenders amounted to PHP56.406 billion.

Rizal Commercial Banking Corporation (RCBC) chief economist Michael Ricafort, in a reply to e-mailed questions from the Philippines New Agency, attributed the partial award “to the higher bid yields, reflecting less need for the government to borrow locally after the recent foreign borrowings/bond sales and the seasonal increase in tax revenue collections in April and as the election is less than two weeks away.”

“The higher US/global bond yields may have prompted the higher bid yields amid more aggressive Fed rate signals, with the widely expected +0.50 Fed rate hike on May 4, 2022, +2.00 Fed rate hikes by September 2022, and +2.50 Fed rate hikes by end-2022 being priced in by the markets, thereby leading to some rejections and partial awards during the auction,” he added.

The Federal Reserve hiked its key rates by 25 basis points last March, the first since December 2018, to between 0.25 to 0.50 percent to help address the accelerating inflation rate.

US’ consumer price index (CPI) continues to soar to its 40-year high in the first quarter of 2022, with the March 2022 level at 8.5 percent. (PNA)