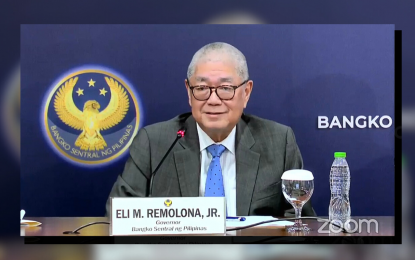

STEADY. Bangko Sentral ng Pilipinas’ (BSP) policymaking Monetary Board (MB) maintained the central bank’s key policy rates during the rate-setting meeting on Thursday (Sept. 21, 2023) to 6.25 percent for the target reverse repurchase (RRP) rate. However, BSP Governor Eli Remolona Jr. said the MB hiked the central bank’s 2023 average inflation forecast from 5.6 percent to 5.8 percent and the 2024 projection from 3.3 percent to 3.5 percent, after citing that risks to inflation continue to lean on the upside. (Photo grabbed from BSP’s Facebook page)

MANILA – Monetary authorities kept the central bank’s key rates steady on Thursday amid the hike in the 2023 and 2024 inflation forecasts, but indicated the possibility of a rate hike in November.

In a briefing, Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. said the Monetary Board (MB) now sees an elevated inflation path until next year but still forecasts the feasibility of deceleration of inflation to within the government’s 2 to 4 percent target band in the last quarter of this year “in the absence of further supply-side shocks.”

“While food and transport prices continue to drive headline inflation, core inflation has moderated further, implying an easing in underlying pressures. In addition, inflation expectations remain anchored to the target range over the policy horizon,” he said.

To date, the BSP’s target reverse repurchase (RRP) rate is at 6.25 percent, the overnight deposit rate at 5.75 percent, and the overnight lending rate at 6.75 percent.

The seven-man MB revised upward the central bank’s average 2023 inflation forecast to 5.8 percent from 5.6 percent during the Board’s rate setting meet last Aug. 17.

It also hiked the 2024 average inflation projection from 3.3 percent to 3.5 percent.

On the other hand, the 2025 average inflation forecast was maintained at 3.4 percent.

The rate of price increases registered an uptick last August to 5.3 percent from 4.7 percent in the previous month, ending its six-month deceleration and bringing the year-to-date average to 6.6 percent.

Remolona attributed the upward revision in the average inflation forecast until next year to “spillovers from weather disturbances, rising global crude oil prices, and the recent depreciation of the peso.”

He said “balance of risks to the inflation outlook remains skewed toward the upside” given the potential effects of hikes in transport fares and electricity rates.

He added additional risks come from waning pent-up demand in the domestic economy and the impact of the series of past interest rate hikes.

The continued implementation of non-monetary measures has been also underscored to help address inflationary pressures.

“The BSP reassures the public of its commitment to steer inflation towards a target-consistent path over the medium term in line with its primary mandate to ensure price stability,” Remolona said.

With these factors, the central bank chief, who is also the MB Chairman, said he expects a possible rate hike during the Board’s next rate-setting meeting in November.

“Honestly, yes,” he said, but declined to elaborate how much the increase would be.

“I expect rates at the level thereat at the end of this year,” he said, discounting any rate cut for at least the first half of 2024.

In terms of the impact of the Federal Reserve’s key rate decisions after its two-day meeting that ended Sept. 20, Remolona said “it figured very slightly.”

He said decision of the Federal Open Market Committee “suggested a bit more dovish stance this year and a bit more hawkish stance next year.”

This is expected to translate to a possible one 25 basis points increase in the Federal Reserve funds rate before this year ends, instead of the earlier projection of two 25 basis points hike; and a total of 50 basis points rate cut, instead of 100 basis points, next year.

“So that means next year maybe a stronger dollar than otherwise because it’s a more hawkish stance next year but it’s gonna be very slight in our estimate in terms of its effect on the Philippines,” he added. (PNA)