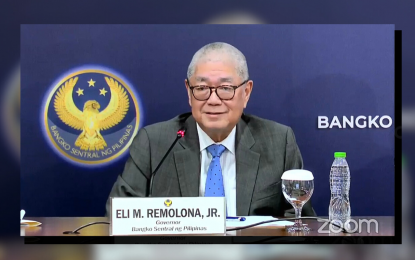

RATE HIKE. Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. says on Wednesday (Oct. 11, 2023) that a 25-basis point rate hike is possible next meeting. The BSP has so far raised rates by a total of 425 basis points since last year. (PNA file photo)

MANILA – Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. said on Wednesday that the Monetary Board is not ruling out a 25-basis point rate hike in its meeting next month.

"We are considering hikes, yes. But we're going with where the data leads us," Remolona said in a press briefing.

Sought to comment on National Economic and Development Authority (NEDA) Secretary Arsenio Balisacan's statement that a further rate hike would affect the economy, Remolona said, "I don't think Arsi's views and our views are that far apart."

"I think what Arsi really meant was we should not go for a very aggressive hike but I wouldn't rule out 25 basis points for example," he said.

The Monetary Board has so far kept interest rates steady at 6.25 percent for four consecutive meetings.

Remolona said the BSP is keeping a close eye on the inflation data.

Headline inflation accelerated to 6.1 percent in September from 5.3 percent in August.

"We're looking at the numbers, looking at them twice, three times. The upside risks that we feared, some of them materialized already. One thing we were worried about was transport fare hikes and that has happened. I wouldn't say that we're done with the tightening," he said.

Remolona said they are looking if the supply side shocks will have a lasting impact.

"Normally, they don't have a lasting impact but once they get into expectations, once they get into wages, it becomes an issue for us. Of course, we only control the demand side and for now, we think tightening has relieved pressure from the demand side. So far, we think it hasn't really affected our growth prospects, we're watching that very carefully," he added.

Despite the pickup in headline inflation last month, core inflation, which excludes volatile oil and food items, went down to 5.9 percent from 6.1 percent.

Remolona said the decline in core inflation is "encouraging."

"For us, the core number is what reflects monetary policy," he said. (PNA)