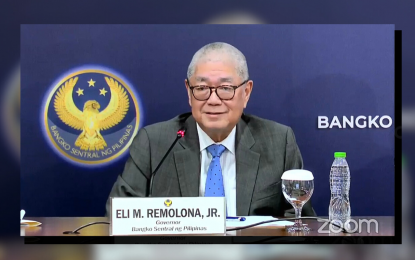

Bangko Sentral ng Pilipinas Governor Eli Remolona Jr. (File photo)

MANILA – Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. said the Monetary Board of the BSP is now less likely to cut policy rates during its next meeting this month due to the acceleration in headline inflation.

In an interview at the sidelines of the official launch of the Financial Services Cyber Resilience Plan held at the Philippine International Convention Center in Pasay City on Tuesday, Remolona said the BSP "is a little bit less likely [to cut rates] kasi mataas ng inflation (because inflation is high)."

Headline inflation accelerated to 4.4 percent in July from 3.7 percent in June.

Remolona said the July inflation data is "slightly worse than expected."

"The 4.4 percent may kasamang base effect yan na 0.3 [percentage points] (There's a base effect of 0.3 percentage points). So without the base effect, it's really 4.1 [percent]. Which is still worse than expected but not that bad no kasi nabreach lang ng kaunti ‘yung ceiling (there was a little breach in the ceiling)," Remolona said.

The Monetary Board of the BSP has so far kept the target reverse repurchase rate at 6.50 percent for six consecutive meetings.

During earlier interviews, Remolona signaled the possibility of easing policy rates during the Monetary Board's next meeting which is scheduled on Aug. 15.

Asked whether a rate cut is still on track, Remolona said "somewhat," adding the BSP is also "always open" to the possibility of an off-cycle easing.

Remolona, when asked on what would warrant an easing, said, "if growth is unexpectedly weak, and then it looks like our projections of inflation and inflation expectations suggest lower inflation going forward, so we can cut."

Official second quarter Philippine economic growth data will be released on Aug. 8. (PNA)